Do you know that in AutoCount Accounting, we can reset GST processor?

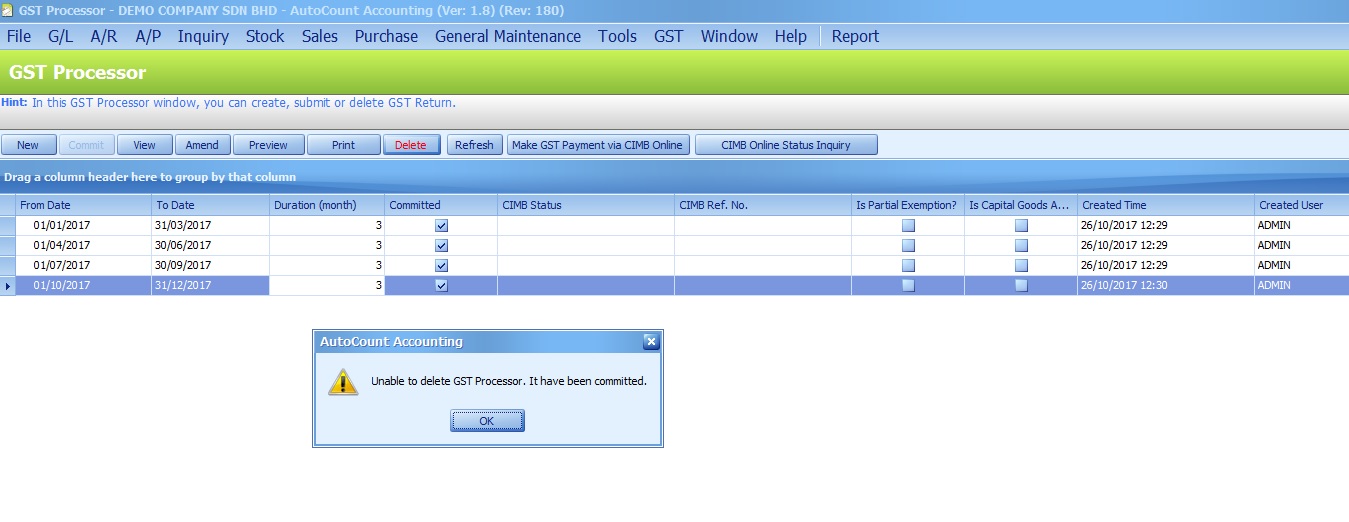

Some user will face this message pop up show Unable to delete GST Processor. It have been committed.

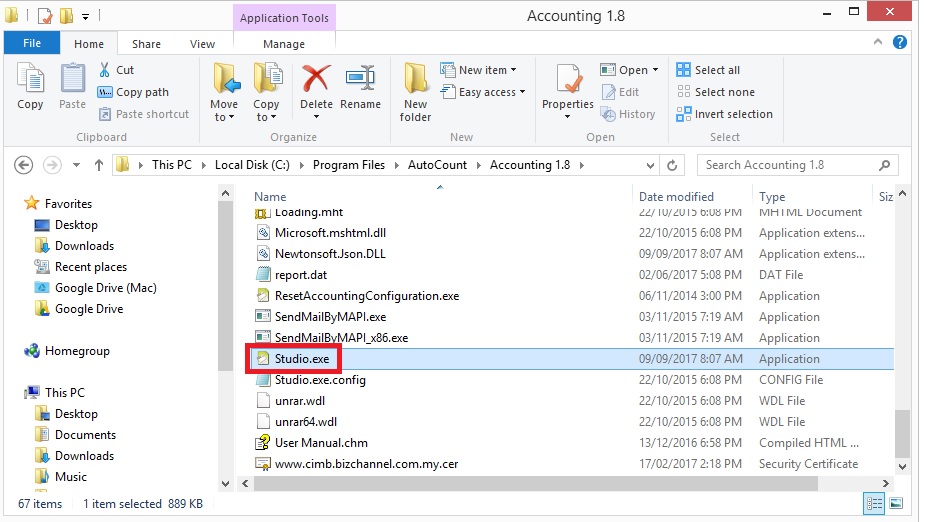

Step 1:

Step 1:

Try look into your computer C:\Program File\AutoCount\Accounting 1.8 you will able see icon Studio.exe

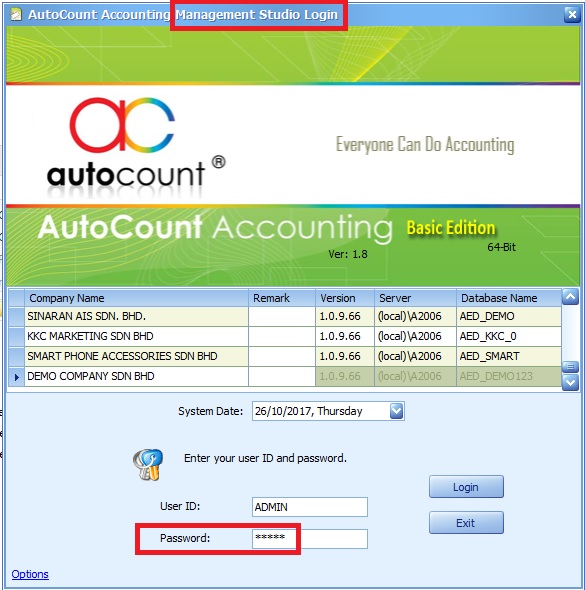

Step 2:

Log in your account book & type in your admin password.

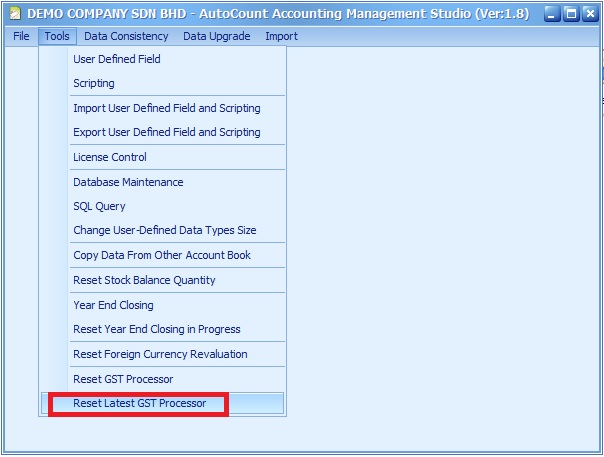

Step 3:

Tools>Reset Latest GST Processor.

Notice:

- Reset GST Processor – this will reset whole submission GST period.

- Reset Latest GST Processor – this only reset your latest submission GST period.

Step 4:

Just Click Yes to continue.

Step 5:

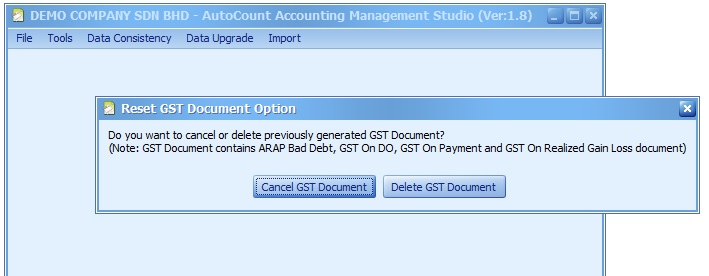

Cancel GST Document – This will show status cancelled document in Journal Entry ARAP Bad debt, GST on DO, GST on Payment and GST on Realized Gain Loss.

Delete GST Document – This will do remove document in Journal Entry ARAP Bad debt, GST on DO, GST on Payment and GST on Realized Gain Loss.

Step 6:

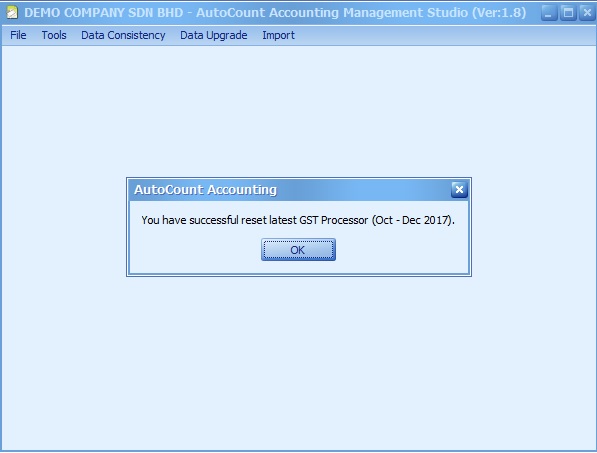

You will see pop up message successful reset latest GST Processor.

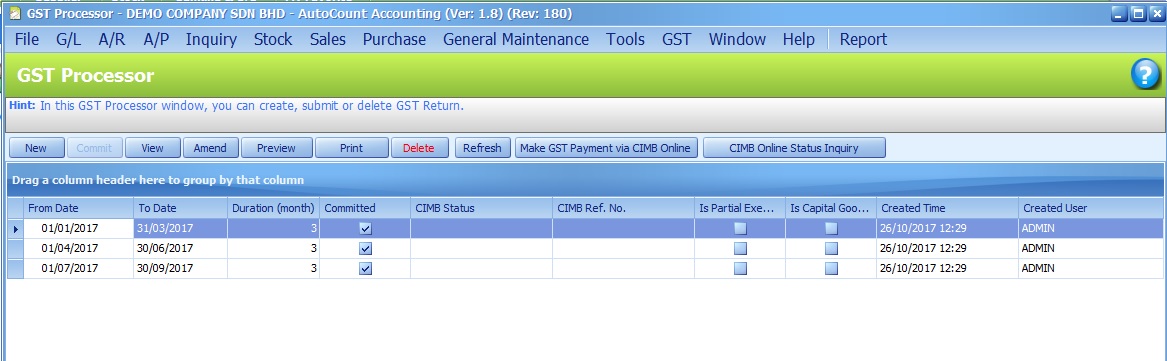

Result :

Gst taxable period 01/10/2017 – 31/12/2017 will be removed.

Happy AutoCount Accounting 1.8